You don’t have to look too hard to come across a conversation about the Toronto real estate market this year. In some respects, it really makes this year no different than any other in recent memory. Toronto real estate is a very popular and a highly divisive topic.

In today’s media reports some say the sky is falling for Toronto’s normally prolific market, others say that the fall has already happened and now we are poised to pick up steam in 2023.

Confused? You are not alone – a lot of people are truly unsure of what is happening and, justifiably, find themselves concerned. So what is really going on?

The market is certainly making adjustments and the people who traditionally feel these changes happening first, are those that work in the industry. Much like we were the first to feel the cool-down starting in late February 2022, a time when most reporting in the media was geared towards the market being seller-centric; we are starting to feel something change again.

Here are a few facts about this current real estate market.

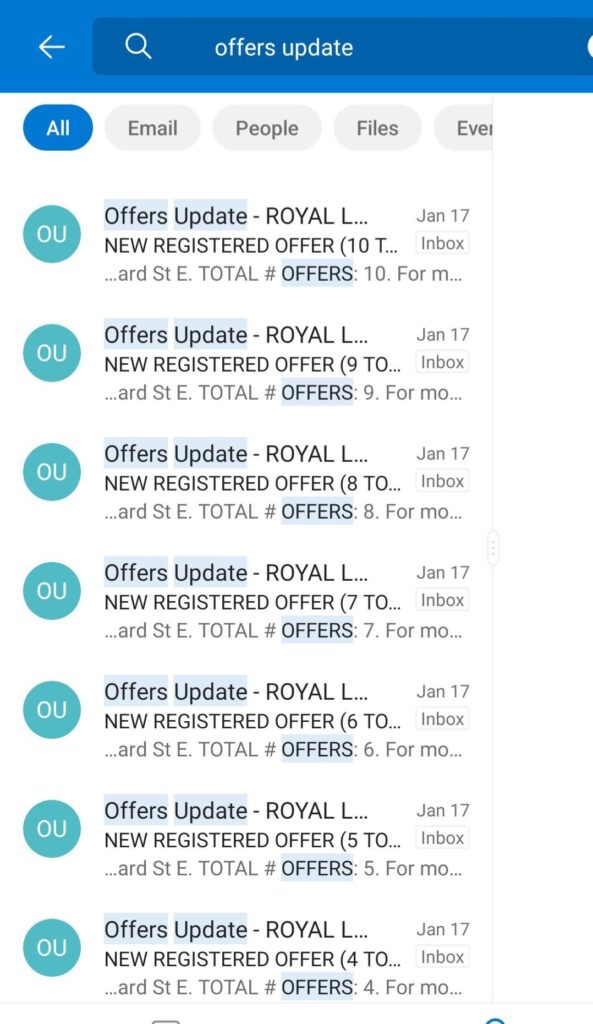

- Multiple offers still exist. A house I listed in Wexford-Maryvale received 14 offers in mid-December. In January my Buyer submitted an offer on a Downtown condo with 8 other offers while another Buyer offered on a house on a main street in Leslieville with 10 other offers.

- Buyers are still out there. Some buyers are hoping to use mortgage commitments before additional hikes, some are hoping to take advantage of the current softening of the market while it lasts, and others are just wanting to buy a new home!

- Inventory is low. Some people still need to sell; they are moving to or from the city, or perhaps downsizing because it is time. However, it does look like those who don’t have to sell, are holding off making that decision. This in turn has created a lack of inventory and is helping to keep prices steady. According to TRREB Chief Market Analyst Jason Mercer, “The number of homes listed for sale in 2022 was down in comparison to 2021. This helps explain why selling prices have found some support in recent months.” He also noted, “If we don’t see a meaningful shift upwards in terms of supply then that would start to exert upward pressure on prices once again.”

- Interest rate increases have affected the market. There is no denying this – and they were meant to cool it down. We saw another increase happen yesterday but the Bank of Canada also indicated that they were hitting “pause” on future increases. According to a recent article by two industry experts in the Financial Post, if there is a stabilization of rates “it is not unlikely that housing prices will reverse course.”

- Mortgage lenders seem to be willing to allow people to amortize over a longer period. This will help to decrease the payment shock that those renewing mortgages will be worried about. Which, in theory, will reduce the amount of distressed households that, might otherwise, need to sell their homes. It’s possible that we won’t see enough distressed sellers to materially impact home prices.

- Despite all the doom and gloom – prices have increased. Average residential prices were up 2.4% in 2022 relative to 2021. Sure there were month-to-month declines in 2022 but it might help to know that a longer term comparison shows the benchmarked price in December was up 33% over the past 3 years.

So what does this mean for the housing market in 2023?

It appears as if a housing market recovery is possible in Canada this year. Murtaza Haider and Stephen Moranis summarized their Financial Post article by stating,

“Canadian housing markets have rationally reacted to the overall changes in the macroeconomy. The declines in sales and prices were the logical and measured response to a host of shocks to the economic system. Minus an unexpected large future shock, 2023 is likely to report a housing market recovery in Canada.

Murtaza Haider is a professor of real estate management and director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran.

Are we at the lowest point? And if not, how much does it matter? The great investor Baron Rothschild once said “I never buy at the bottom and I always sell too soon”. In other words, your chances of picking the bottom and the top of the market are very slim. However, the preponderance of evidence indicates that the market has dropped substantially since March. So on probability alone an upward trend is more likely for 2023.

Your home is more than a long term investment so a reasonable strategy might be to buy when things are low enough and sell when they seem high enough that way you avoid being swept along to those wild extremes that often prove so disastrous.

[…] few weeks ago I wrote a blog talking about what we might expect from this year’s market. In general, I sensed that things […]